modified business tax return instructions

Tax Forms and Instructions This packet contains. The amended return must include any resulting adjustments to taxable.

For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of.

. Total gross wages are the total amount of all gross wages and. Modified Business Tax. The Michigan Business Tax MBT which was signed into law by Governor Jennifer M.

Line-through the original figures in black ink. Were modified to include certain licensed Professional Engineers and to expand the definition of qualified program. United Kingdom Finance Act 2021 Impacts Deferred Tax In Company.

PREVIOUS DEBITS Outstanding liabilities AMOUNT. Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to.

Oklahoma business codes are the same as federal business codes. Submit the DR 1366 with your return. Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions.

COMPOSITE RETURN INFORMATION Any partnership required to file an Oklahoma income tax return may elect to file. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. MODIFIED BUSINESS TAX RETURN 1.

If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. Right click on the form icon then select SAVE TARGET. The documents found below are available in at least one of three.

Gross wages payments made and individual employee. It requires data and information you should have on-hand. The amended return must be filed within the time prescribed by law for the applicable tax year.

Instructions contains information about how to complete each label on the company tax return including company information Items 130 the calculation statement and declaration. To get started on the blank use the Fill Sign Online button or tick the preview image of the blank. Monday March 14 2022.

The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount equal to. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. Strategic Capital Tax Credit from DR 1330 the sum of lines 12 13 and 14 cannot exceed line 11 you must submit the DR 1330 with your return. The Nevada Modified Business Return is an easy form to complete.

How you can complete the Nevada modified business tax return form on the web. Modified business tax return instructions. Include a copy of the original return 2.

Year or have had. Write the word AMENDED in black ink in the upper right-hand corner of the return.

Instructions For Form 5471 01 2022 Internal Revenue Service

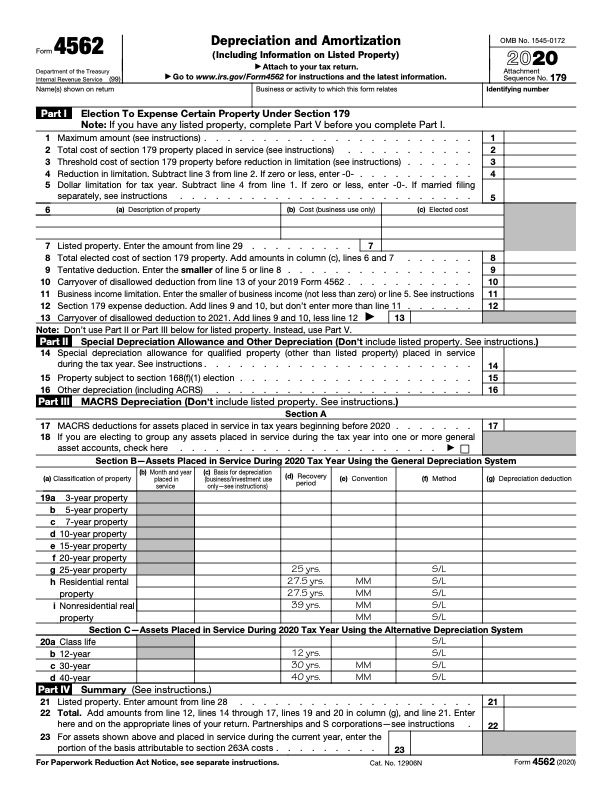

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Publication 974 2021 Premium Tax Credit Ptc Internal Revenue Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How To Complete Form 1120s Schedule K 1 With Sample

2020 Draft Form 1065 Instruction Indicates Changes In Partners Capital Account Reporting Windes

Instructions For Form 1040 Nr 2021 Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef